519217023 Best Growth Stocks to Buy in 2025

Identifying the most promising growth stocks for 2025 requires a meticulous evaluation of fundamental metrics, earnings forecasts, and valuation indicators. Investors must consider companies with sustainable revenue expansion, manageable P/E ratios, and favorable enterprise value-to-EBITDA ratios. Stable dividend yields can enhance appeal, but market sentiment and macroeconomic trends also influence potential returns. The challenge lies in balancing these factors to pinpoint stocks that offer both growth potential and risk mitigation as the market evolves.

Strategic Factors for Identifying Top Growth Stocks

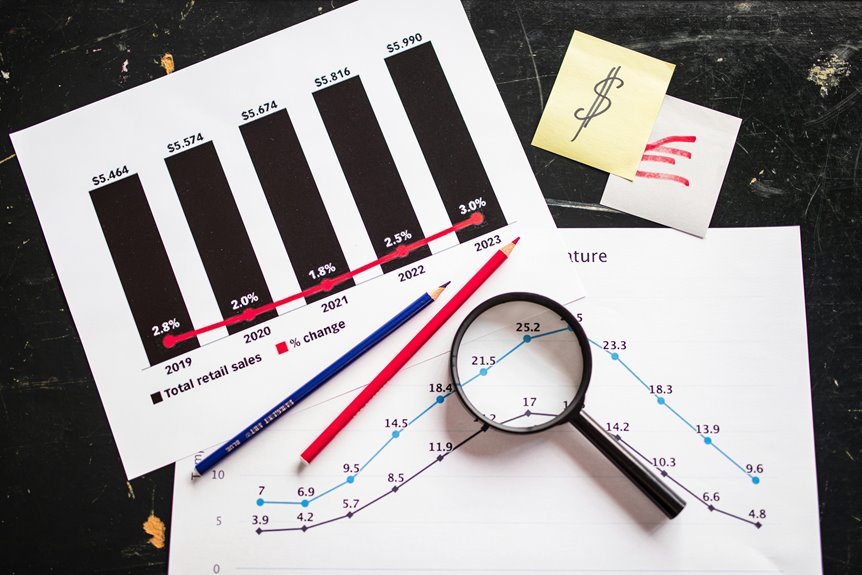

As the investment landscape evolves in 2025, discerning investors are increasingly focused on identifying growth stocks with the potential to deliver substantial returns. Central to this pursuit is a meticulous analysis of market valuation, which serves as a critical indicator of a stock’s relative worth. Investors seek companies with strong fundamentals that are undervalued relative to their growth prospects, enabling the possibility of significant capital appreciation.

Equally important is the evaluation of dividend yields, which provide a measure of income generation and reflect a company’s confidence in its ongoing profitability. While growth stocks traditionally prioritize capital gains over dividends, a sustainable dividend yield can signal financial stability and management’s commitment to rewarding shareholders, adding an extra layer of confidence for investors aiming for long-term freedom.

In selecting the best growth stocks, investors examine a company’s price-to-earnings (P/E) ratio in conjunction with projected earnings growth to avoid overpaying for future potential. A low to moderate market valuation, coupled with high earnings growth forecasts, indicates an attractive entry point.

Additionally, examining dividend yields helps differentiate between firms that balance growth initiatives with shareholder returns and those solely reinvesting profits for expansion. Such analysis ensures alignment with an investor’s strategic goal of capital appreciation while maintaining a moderate income stream.

Furthermore, the assessment of market valuation dynamics, including price-to-sales ratios and enterprise value, offers insights into market sentiment and potential undervaluation. Growth stocks with reasonable valuations and stable or improving dividend yields present compelling opportunities for investors seeking to maximize freedom through capital growth.

Precision in this analytical approach is essential for navigating the complexities of the evolving 2025 investment environment.

Conclusion

In conclusion, prudent investors prioritize precise principles—paying close attention to profit growth, valuation viability, and market momentum. By balancing bullish benchmarks with balanced benchmarks, they bolster their portfolios with promising, profit-producing prospects. Systematic scrutiny of sustainable scores and strategic stock selections fosters financial freedom, forging a foundation for future gains. Ultimately, disciplined diligence delivers durable dividends and dynamic growth, demonstrating that meticulous metrics and methodical management are paramount for maximizing long-term wealth.